(© Chinnapong - stock.adobe.com)

In a nutshell

- In many Decentralized Autonomous Organizations (DAOs), insiders such as developers and project owners hold enough voting power to influence or control major decisions, undermining the promised democracy of these platforms.

- Researchers observed that governance token ownership often shifts significantly just before key votes, suggesting that insiders may strategically acquire voting power to influence decisions in their favor.

- The findings raise serious questions about the transparency and accountability of DAOs, with regulators increasingly focused on identifying who truly controls these decentralized systems, especially following incidents like the Tornado Cash sanctions.

VIENNA — The crypto revolution promised to eliminate middlemen and democratize finance, but researchers have uncovered that Decentralized Autonomous Organizations (DAOs) have a dirty secret. According to a new international study, the insiders who created them often maintain enough control to dictate decisions, making a mockery of their democratic branding.

The research, published in Financial Cryptography and Data Security, revealed that in about 8% of DAOs, the insiders – developers, administrators, and project owners – held enough voting power to control decisions all by themselves. Even worse, these insiders single-handedly determined the outcome of at least one proposal in more than 20% of DAOs.

Even though these organizations market themselves as democratic, many actually work more like groups controlled by a small number of insiders with a lot of power.

For anyone unfamiliar with the crypto world, DAOs are supposed to be democratic communities where members vote on decisions using special “governance tokens.” The more tokens you hold, the more voting power you have, similar to owning shares in a company, but with decisions made directly by token holders instead of a board of directors.

The research team examined almost a million voters across 872 DAOs, analyzing over 5 million votes. They discovered that even major financial platforms like Uniswap, which handles billions in trading volume, showed concerning levels of insider control.

How Insiders Maintain Control

The study exposed three major ways insiders maintain control despite the democratic façade. First, contributors (the study’s term for insiders) occupy central positions in voting networks. Essentially, they’re the popular kids sitting at the cool table. Their influence spreads further because of their position.

“In our study, we found signs of ‘inner circles’ forming in many DAOs,” says study author Stefan Kitzler from Complexity Science Hub, in a statement. “As contributors tend to be centrally positioned within the DAO governance ecosystem and often hold disproportionately high influence.”

Second, these insiders tend to vote together in patterns that look suspiciously like coordinated voting blocs.

Lastly, right before important votes, there are sudden shifts in who owns governance tokens. In nearly 15% of proposals studied, significant changes in voting power occurred days before the vote. This could be a coincidence, but it also could be a strategic manipulation tactic.

Instead of long-term community members making decisions based on what’s best for everyone, we’re seeing what looks like strategic voting power grabs right before important decisions. The researchers found that contributors participated in over 60% of proposals where these majority shifts occurred, suggesting they may be involved in these strategic token movements.

Major Crypto Platforms Aren’t Immune

You might assume this problem only affects small, unknown DAOs, but the study found even the crypto big leagues aren’t immune.

Uniswap, one of the largest decentralized exchanges where people trade billions in crypto, showed nearly 30% contributor involvement in voting. Aave, a major lending platform, wasn’t far behind at 28%. Even in these massive organizations, insiders still maintain outsized influence.

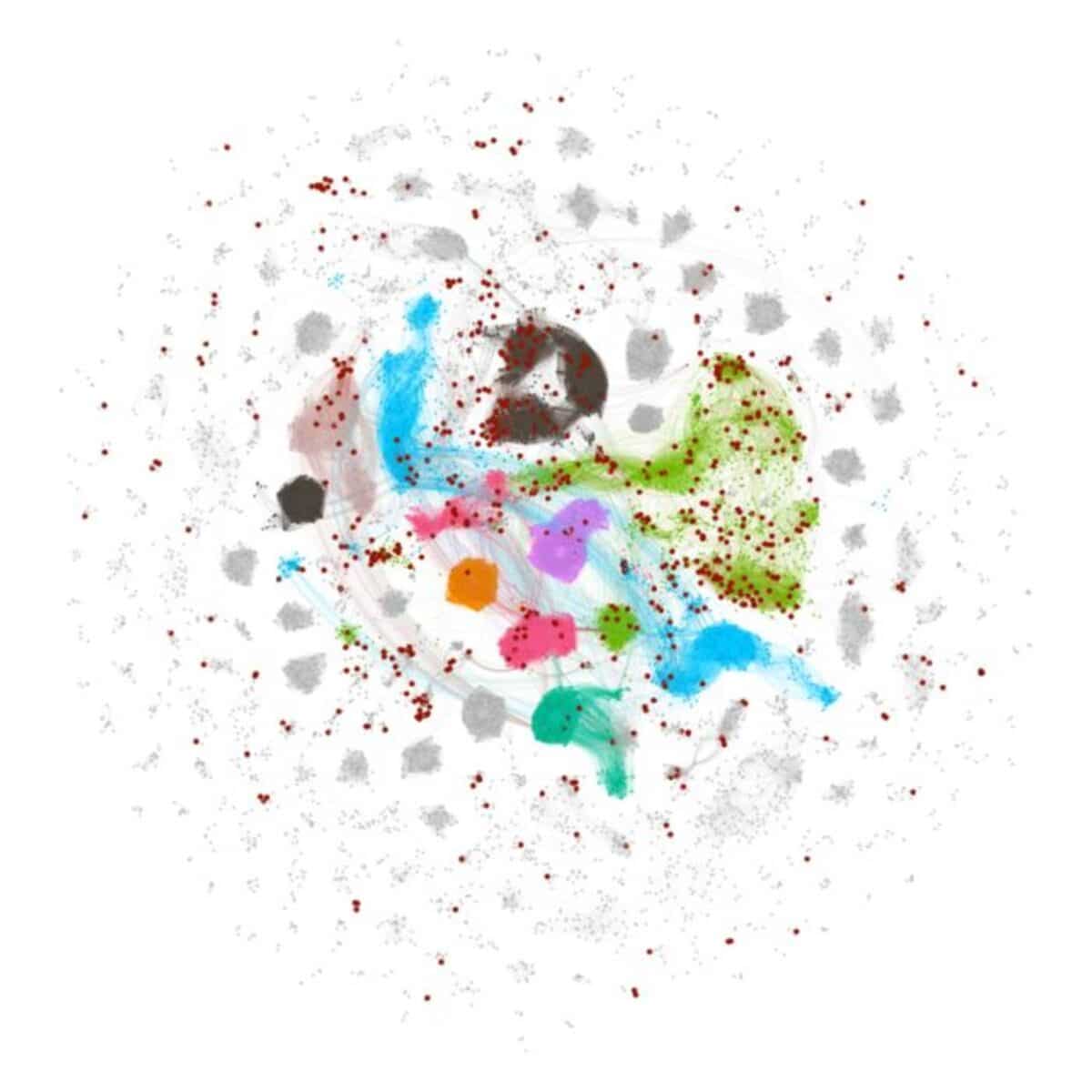

The research team built what amounts to a social network map of voting behaviors, showing who tends to vote with whom. These maps revealed that insiders typically occupy central positions and tend to cluster together in voting communities.

This means insiders stick together and maintain positions of influence, forming what looks like inner circles within these supposedly democratic organizations.

The Regulatory Reckoning

These findings blow a hole in the narrative that DAOs represent true decentralized governance. If a small group of insiders can effectively control outcomes, are these organizations really any different from traditional companies with a democratic veneer?

Financial regulators are increasingly looking to identify who controls these supposedly “decentralized” protocols. After incidents like the Tornado Cash sanctions, where developers allegedly manipulated governance to avoid anti-money laundering controls, understanding who really pulls the strings has become crucial.

For anyone who thought DAOs represented a revolutionary alternative to traditional governance systems, this study delivers a sobering reality check. The promise of decentralization appears significantly compromised, raising fundamental questions about whether truly democratic digital organizations are possible or merely clever marketing.

Paper Summary

Methodology

The researchers gathered data from multiple sources: Snapshot (an off-chain governance platform), the Ethereum blockchain, Ethereum Name Service, and The Graph. They identified 986,557 voters across 872 DAOs with 7,478 recognized contributors. To ensure accuracy, they cross-verified 438,668 votes from 8,116 proposals against blockchain records, finding 97.48% consistency. They measured contributor influence by calculating voting power across proposals, analyzing decision-making involvement, and building co-voting networks to map voting patterns. They also tracked token balance changes before votes to spot strategic behavior.

Results

The study revealed that in 7.54% of DAOs, contributors held enough voting power to control governance decisions on average. In 20.41% of DAOs, contributors’ votes singularly determined at least one proposal outcome. Network analysis showed contributors occupy central positions in voting networks and form voting clusters, suggesting power circles. In 14.81% of proposals, significant shifts in token ownership occurred days before voting, with sharp increases right before polls, indicating strategic token acquisitions. These patterns appeared even in major DeFi protocols managing billions in assets.

Limitations

The research primarily examined off-chain voting on Snapshot rather than all on-chain voting across multiple blockchains. The researchers acknowledge they likely identified only a portion of all contributors, as incorporating more data sources would probably increase the number of identified insiders. While they identified patterns of pre-voting token acquisitions, they couldn’t definitively prove the intent behind these movements.

Funding/Disclosures

The paper doesn’t specifically mention funding sources or conflicts of interest in the examined section. The research team includes scholars from the Complexity Science Hub Vienna, AIT Austrian Institute of Technology, University of Mannheim, and GESIS – Leibniz Institute for the Social Sciences.

Publication Info

“The Governance of Decentralized Autonomous Organizations: A Study of Contributors’ Influence, Networks, and Shifts in Voting Power” was authored by Stefan Kitzler, Stefano Balietti, Pietro Saggese, Bernhard Haslhofer, and Markus Strohmaier. The study was published in Financial Cryptography and Data Security in February 2025.